skilpod.com / blog

affordable building — housing finance: how do I get started?

When buying a new-build home, like our Skilpods, it is important to be well-informed about the financial steps you need to take. Whether you are buying your first home or selling your existing home and buying a new one, this guide will help you through the process.

Buying a new home: this is how you start

Purchase costs

When buying a property, you will encounter several costs. These are the main ones:

- Building plot purchase and registration fees (12%): buying building plot comes with registration fees that amount to 12% of the purchase price.

- Purchase new build property and VAT (6% or 21%): depending on the situation, you will pay 6% or 21% VAT on the purchase price of the property.

- Architect fees: to ensure that your interests are represented independently, as a contractor we are not allowed to appoint the architect. The architect's fee is therefore not included in our all-in price.

- Notary fees: this includes the costs for drawing up the deed and administrative handling.

- Ground probing: at Skilpod, ground probing is included in the price, something that is often not the case with our competitors.

- Connection of utilities: for houses that are built in Belgium, we also include these costs. With many other providers you have to pay this separately.

Determine your budget

Before talking to a financial institution, it is important to have your budget clear. Here are some steps you can take:

- Monthly income and expenses: make an overview of your current financial situation. Write down all income sources and expenses.

- Future expenses: think about how much you will need monthly for maintenance, insurance, water and electricity.

- Outdoor landscaping: set aside a budget for the construction of your garden and other outdoor spaces.

Preparing for the interview

Prepare well for an interview with a mortgage broker or bank:

- Collect financial documents, such as pay slips and bank statements.

- Think about your financial options and how much you can comfortably repay each month.

- Consider an appointment at 'hypotheekwinkel' for tailored advice.

Selling your current home and buying a new one

Combining sale and purchase

If you are selling your current home and buying a new one, there are some important things to keep in mind:

- Bridging loan: this loan helps you bridge the period between buying your new home and selling your old one.

- Quick completion: At Skilpod, we understand that timing is crucial. Our fast and efficient construction process allows you to move into your new home sooner, which can significantly reduce the period of double burdening. Specifically, that means you can move into your Skilpod within a year of signing your building contract.

Collaboration with financial experts

At skilpod, we work with a financial products broker who can help you find the cheapest bridging loan on the market and increase your borrowing capacity. For more information on finance, you can also visit the mortgage shop.

Meer informatie

For detailed information on the costs associated with buying a property, visit notaris.be.

At Skilpod, we make sure you are fully informed and are happy to help you through the entire process. Want to know more about the financial side of buying a skilpod home? Schedule an appointment with one of our skilpod experts.

more about our building process

building process — improve your chances of finding the perfect building plotDid you find the Skilpod of your dreams, then it's time to find your ideal location.

smart building — 11 homes in 4 daysWe did it again. At the historical site of the Chocolate Factory in Tongeren, we built 11 new homes in 4 days.

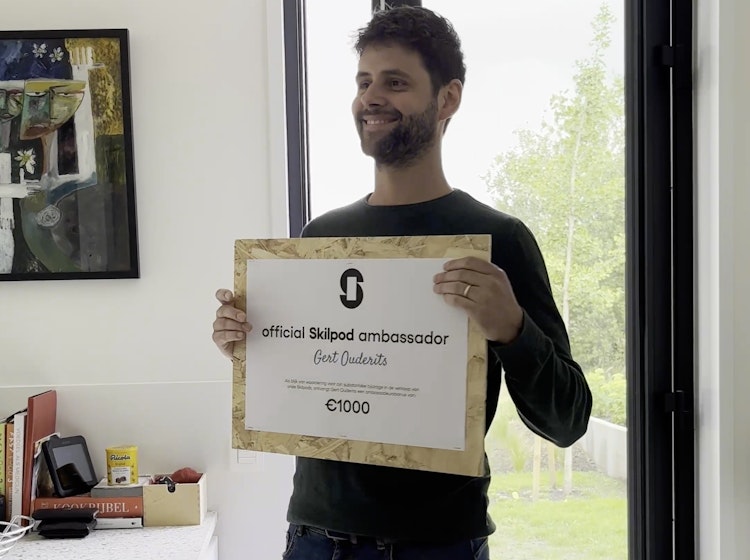

building process — what is the Skilpod ambassador bonus?Of course we love it when our fans recommend us to other people. So much so that we decided to give them a reward: the ambassador bonus